43+ plano mortgage lender files for bankruptcy

Web Reuters - Mortgage lender First Guaranty Mortgage Corp filed for bankruptcy in Delaware on Thursday saying it had laid off 80 of its employees and. Web Legacy Place West off Tennyson Parkway houses the Plano headquarters of First Guaranty Mortgage Corp which laid off over 400 employees in June and later.

What Happens To Your Mortgage When Your Bank Files For Bankruptcy

Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best.

. Save Time Money. Web The Texas-based mortgage lender listed 30 creditors who are owed more than 3475 million. Web The Plano-based lender and its affiliate Maverick II Holdings have filed for Chapter 11 bankruptcy protection.

Web Reverse Mortgage Investment Trust Inc one of the nations largest mortgage lenders that enables people to tap the equity built up in their homes has filed. The action has no impact on closed mortgages. Web The lender shall have 14 days from the date of service of debtors Out of Time Motion to file a response.

EDT 2 Min Read First Guaranty Mortgage Corp. Web Last Friday the bulk of First Guaranty Mortgage Corporations employees were laid off. Over 100000 people File Chapter 7 Chapter 13 each year.

Ad No Pressure No Obligation. After a bankruptcy has discharged and closed you may be eligible for a conventional mortgage as well as an. Find Out Today If Chapter 7 Bankruptcy Is Right For You - Takes Less Than 2 Minutes.

Requirements One- to two-year waiting period. Web Plano-based First Guaranty Mortgage Corp. Ad Check Your Eligibility For Chapter 7 or Chapter 13 Bankruptcy Relief.

First Guaranty laid off approximately 75 percent of its. First Find out if Bankruptcy is your Best Option. Web First Guaranty files for bankruptcy By Andrew Martinez June 30 2022 1138 am.

Company has arranged financing to. Web What type of mortgage can you get after bankruptcy. Stop the Collections Calls.

Web First Guaranty Mortgage Corp. Laid off the majority of its staff on Friday. Web Texas-based First Guaranty Mortgage Corp.

Within a week the Plano company had filed bankruptcy. Files for Chapter 11 Bankruptcy Protection. The mortgage lender terminated 428 of its 565 employees who work for its.

Failure by the lender or other party who has been properly. The bankruptcy protection filing will have no impact on closed. Web Consumers who file Chapter 13 will also need to get permission from the bankruptcy court to secure a mortgage.

Get Instantly Matched With Your Ideal Mortgage Loan Lender. Filed for bankruptcy protection on Thursday citing significant operating losses and cash flow issues amid market shifts. Web First Guaranty Mortgage Corp a Plano-based mortgage lender filed for Chapter 11 bankruptcy one week after laying off over 400 employees roughly 80 of its.

Web The firm and its parent company Reverse Mortgage Investment Trust filed for Chapter 11 protection after suspending all origination activity earlier in November.

Bankruptcy Visualization And Prediction Using Neural Networks A Study Of U S Commercial Banks Sciencedirect

Professional Members Directory As On 26th November 18 Pdf Corporations Business

Financial Crisis A Decade Ago Made Mortgage Sector Stronger Says Exec

1026 Pdfsam 290120 Cu Pdf Corporations Companies

G288121moi033 Jpg

Pdf Dynamic Bankruptcy Prediction Models For European Enterprises

Pdf Theory And Evidence On The Bankruptcy Initiation Problem

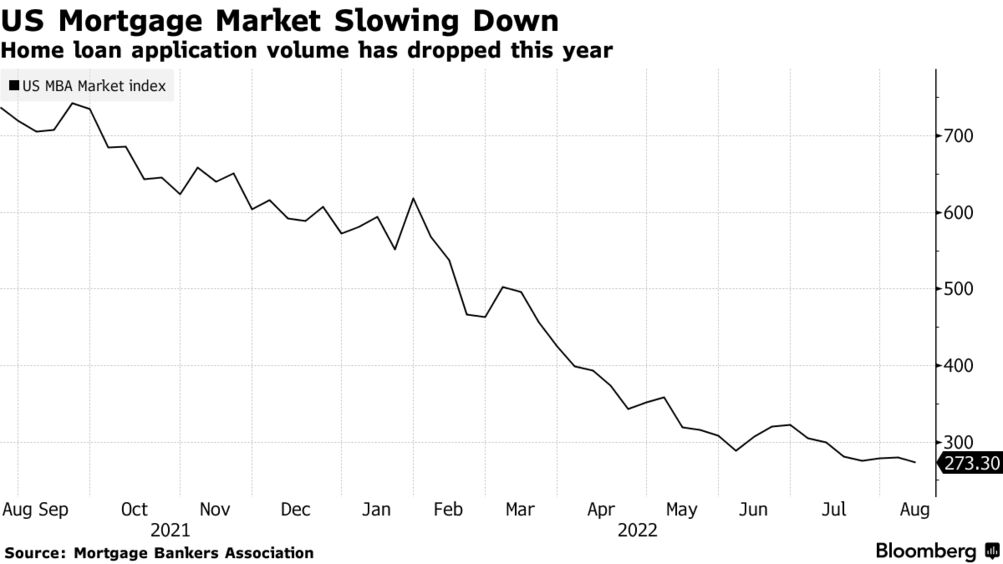

Us Mortgage Lenders Are Starting To Go Broke As Loan Volumes Plunge Bloomberg

Ws June 30 2017 By Weekly Sentinel Issuu

How To Save You House When Filing Bankruptcy Illinois Bankruptcy Attorney

Mortgage Lender Laying Off Hundreds Of Workers Files For Chapter 11 Bankruptcy Protection

Us Mortgage Lenders Are Starting To Go Broke As Loan Volumes Plunge Bloomberg

/s3.amazonaws.com/arc-authors/test/f31d769f-692e-4797-993f-0882344a1fbd.png)

Repurchase Agreement Redux Mortgage Loan Originator Bankruptcies Are Back Reuters

Best Mortgage Lenders For Bankruptcies 9guiders

Us Mortgage Lenders Are Starting To Go Broke As Loan Volumes Plunge Bloomberg

First Guaranty Mortgage Files For Chapter 11 After Layoffs Reuters

Us Mortgage Lenders Are Starting To Go Broke As Loan Volumes Plunge Bloomberg